Local. Vetted. Investments.

Play a part in the success of domestic brands. Invest with Crowdberry.

Active investment opportunities

Become a banker of verified companies and real estate projects or co-own them directly

Boataround

A Slovakian company is digitalising yacht and catamaran reservations in Europe with the vision of becoming the world leader.

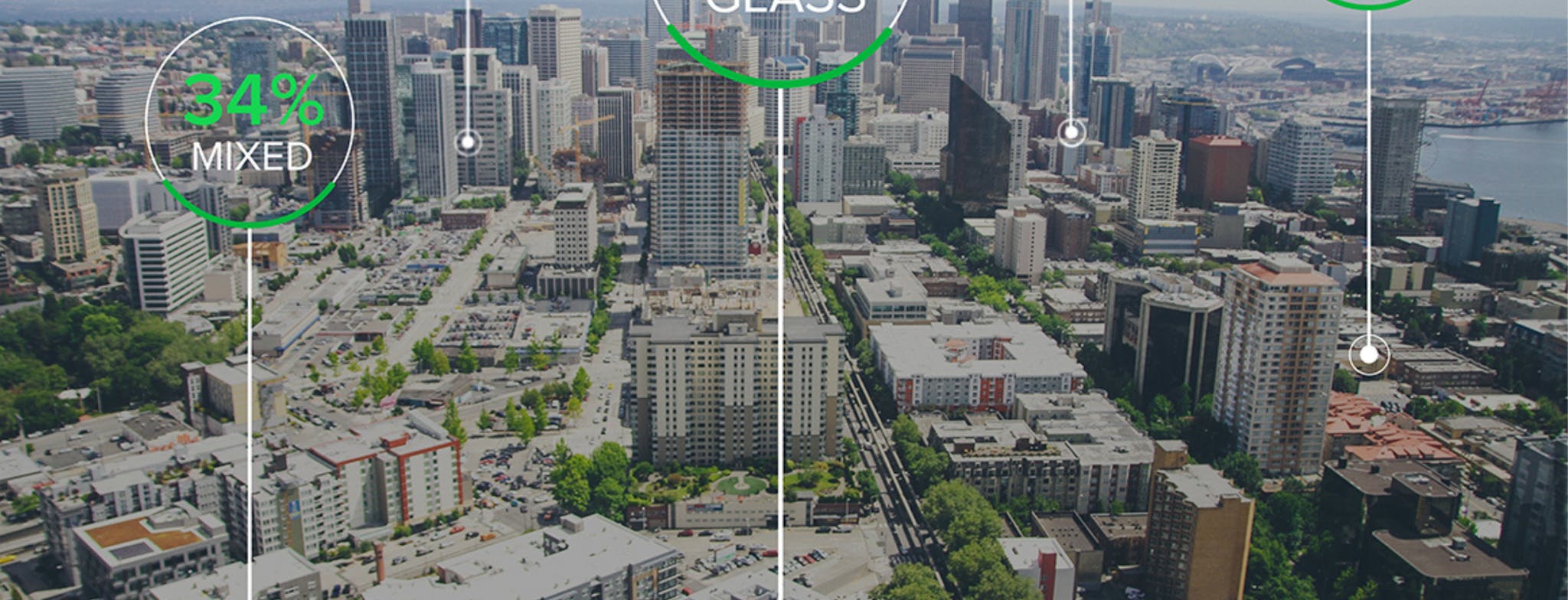

3IPK

Become a co-owner of a Slovak-French technology company with unique software for data verification in aviation and defense.

Creative Pro

Invest with an annual return of 11.6% in a successful group that has tripled in size over 8 years. First tranche limit: CZK 5 million.

Eyerim - 4. tranche

Let your money earn attractive interest by opening profitable optical stores. Last chance to invest until March 23.

Logistics facility Logport Kladno South

Co-own a logistics facility near Prague. 10-year lease, immediate income, and expected 12.5% annual return.

NetCore - IT infrastructure and network management

For more than 1,700 paying customers in North America, Europe, and the rest of the world. Co-own a company that is growing more than 30% per year.

Residential zone Letná - Karlovy Vary

Lend to a developer for the construction of a residential complex in Karlovy Vary, current pre-sales have already reached 93 %.

Boataround

A Slovakian company is digitalising yacht and catamaran reservations in Europe with the vision of becoming the world leader.

3IPK

Become a co-owner of a Slovak-French technology company with unique software for data verification in aviation and defense.

Creative Pro

Invest with an annual return of 11.6% in a successful group that has tripled in size over 8 years. First tranche limit: CZK 5 million.

Eyerim - 4. tranche

Let your money earn attractive interest by opening profitable optical stores. Last chance to invest until March 23.

Logistics facility Logport Kladno South

Co-own a logistics facility near Prague. 10-year lease, immediate income, and expected 12.5% annual return.

NetCore - IT infrastructure and network management

For more than 1,700 paying customers in North America, Europe, and the rest of the world. Co-own a company that is growing more than 30% per year.

Residential zone Letná - Karlovy Vary

Lend to a developer for the construction of a residential complex in Karlovy Vary, current pre-sales have already reached 93 %.

Boataround

A Slovakian company is digitalising yacht and catamaran reservations in Europe with the vision of becoming the world leader.

3IPK

Become a co-owner of a Slovak-French technology company with unique software for data verification in aviation and defense.

Creative Pro

Invest with an annual return of 11.6% in a successful group that has tripled in size over 8 years. First tranche limit: CZK 5 million.

Eyerim - 4. tranche

Let your money earn attractive interest by opening profitable optical stores. Last chance to invest until March 23.

Logistics facility Logport Kladno South

Co-own a logistics facility near Prague. 10-year lease, immediate income, and expected 12.5% annual return.

NetCore - IT infrastructure and network management

For more than 1,700 paying customers in North America, Europe, and the rest of the world. Co-own a company that is growing more than 30% per year.

Residential zone Letná - Karlovy Vary

Lend to a developer for the construction of a residential complex in Karlovy Vary, current pre-sales have already reached 93 %.

Funded companies

Successfully invested companies and real estate projects where private capital boosted the growth and had a wider impact on the economy

From two employees sharing one work table to #2 on the European market – 24,000 boats for rent in 1000+ destinations.

The e-commerce sports nutrition champion from Košice is well on its way to become a unicorn - a company with a billion-dollar valuation.

Investors provided capital for further development of personalised cancer diagnosis tests. The company also celebrated success of its own PCR test for COVID-19, thanks to which it became profitable.

A lifestyle magazine that educates, entertains and influences the modern generation in a positive way.

Investment campaign for a residential project closed in a record 2 days, with total demand reaching almost double.

More than 100 Crowdberry investors have invested a total of more than €2 million in Seonsone smart waste management.

References

The perspective of investors and founders on how private capital supports the growth

I’ve been investing through Crowdberry practically since the beginning and it makes a lot of sense to me. I can see the direct impact of my investments and their power to influence the business environment in Slovakia. I can choose companies whose story resonates with me and have a chance to deliver the expected return. But it’s not just about returns, it’s also about supporting domestic companies that have the potential to grow. It’s important to me that the capital I invest also works at home and makes sense.

What I appreciate about the Crowdberry platform is that it does a lot of the work for me that an investor has to do when investing on their own. The Crowdberry team thoroughly vet the Slovak companies I put my money into, which makes the investment much more likely to be successful. At the same time, I’m excited about the projects they select for investment, because many of them have a strong social or societal impact in addition to an economic one.

Crowdberry is a group of skillful, hardworking and moral people. All agreements, formal or informal, have always been respected. The Crowdberry team spent a lot of work and effort to prepare quality documents about the company and our plans and present them to investors. Even in uncertain times affected by the pandemic, they were able to quickly and efficiently find investors who trusted and supported our company.

Crowdberry enabled me to become a co-owner of CreativePro. Combining the capital and know-how of investors with the vision and ambition of the founder helped to build a local company into the strongest livemarketing agency in the V4 countries. The success of our cooperation was also confirmed by the dividend payouts in 2017.

I invested with Crowdberry three times in the last 18 months. All of them were high-quality investment opportunities. The Crowdberry team ensured the thorough preparation of the entire investment (financial and legal due diligence, negotiation of conditions, documentation, etc.). Thanks to their experience and in-depth knowledge of business analysis and valuations, they come up with innovative investment structures that are well-balanced, satisfying both the investors and founders as well.

My company deals with energy supply from solar sources. I consider Ecocapsule to be a great and progressive project. We helped the team with the development of solar panels and I ordered an Ecocapsule myself. I will travel with it to various places to help promote and sell the capsule throughout Asia.

When it comes to investing, the most important thing for me is the human factor, both in the company I invest in and on the part of the partner mediating the investment. We have a good chemistry with Crowdberry that has very good corporate governance, i.e. investment mechanisms and minority investor protection.

We have been working with Crowdberry for three years, I found out about them through my bank. I was impressed by the very professional team. You can see that they have a keen eye for the goal. Thanks to Crowdberry, everyone has the opportunity to invest in local companies and participate in the development of the whole society.

In 2016, Crowdberry was the only company able to reach smaller investors, so it played a key role for us. Even with our first-ever investment, Crowdberry allowed us to promote our business through their platform. They gave us their seal of credibility and helped out with our marketing plan. We've seen a huge leap forward thanks to them.

News

Keep up with the latest news in the world of investing with Crowdberry

A leader in the international expansion of e-shops, following the successful acquisition of Pošta bez hranic, has acquired a majority stake in Fulfillmenton s.r.o., thereby expanding its platform with its own warehouse capacity. This step allows the company to gain full control over the entire logistics chain.

In recent months, Holding Váš Lekár has focused on streamlining its operations and developing its business, achieving several important milestones that are also significant for the investment opportunity, which you can still join.

Investing in domestic companies and real estate through direct equity stakes in companies or loans is gaining popularity. Investors invested €15.33 million in domestic companies in Q4 2025.